How much does Venezuela owe China, and why is oil involved?

The US takeover of Venezuela’s oil exports has rerouted crude barrels that were being used to service debt owed to China.

How much does Venezuela owe China, and how and why has the country getting debt payments after Venezuela’s default?

Data on Venezuela’s debt is sketchy, particularly since 2017 when US sanctions triggered a sovereign default.

AidData, a research lab at the US university William & Mary, which tracks lending, estimated that official sector Chinese creditors extended loan commitments worth $106 billion to Venezuela between 2000 and 2018. Separately, they calculated that there was $44 billion outstanding in 2017.

Current estimates vary. Societe Generale puts the value of Venezuela’s outstanding debt to China at roughly $10 billion - a figure AidData’s Brad Parks said was consistent with their understanding. JP Morgan estimates total obligations of $13 billion to $15 billion.

Parks said it was unclear whether Venezuela had repaid any of the principal of the outstanding loans since the 2017 default or had only been making interest payments.

Sources at state oil firm PDVSA said China granted Venezuela a grace period for the capital payments in 2019, allowing debt service payments to be compensated for by crude cargoes.

Internal PDVSA documents put crude oil and fuel oil exports to China at 642,000 barrels per day, with a small fraction of that going to debt servicing.

Venezuela has not produced comprehensive, reliable debt statistics for decades. The last figures of any sort were released by the central bank in 2019, making it tough to determine what debts are outstanding and whether the country has taken on more.

The International Monetary Fund, which tracks economies, debt and development, has not produced a comprehensive “Article IV” report on Venezuela since 2004.

This has left outside observers to patch together information based on sourcing, public comments by Venezuelan officials and movements of crude oil exports, the country’s main revenue earner.

After US sanctions were imposed, Venezuela’s primary allies were Russia and China.

AidData’s Parks said most of Venezuela’s public debts to China were contracted with China Development Bank via oil-backed lending arrangements.

Cash proceeds from some of the oil sent to China, Parks said, went into a Beijing-controlled account and on to service the debts - even as sanctions and default kept many other creditors from getting paid.

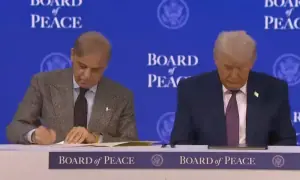

The United States has said it will funnel proceeds of Venezuelan oil sales into a Qatar-based account it controls, from which Washington would have to send funds to China in order to keep servicing the debt.

Comments from the Trump administration have made clear this is unlikely.

China’s largest state-owned oil major, CNPC, also has producing assets in Venezuela. Sinovensa - its most significant joint venture with PDVSA - pumps roughly 110,000 barrels per day. How the US will handle those cargoes is unclear.

Other creditors, including bondholders, are pushing their case in the auction of Venezuela’s most valuable foreign asset, the US refining company Citgo. However, its location inside the United States means China is unlikely to join the fray.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.