Economy enters FY2026 on a high note, says Finance Ministry

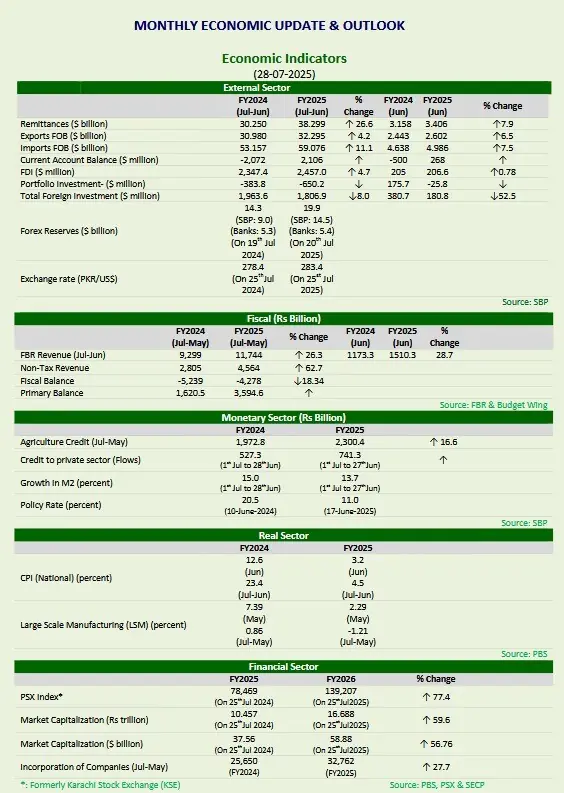

The national economy has entered fiscal year 2025-26 with positive momentum, building on last year’s gains and setting an optimistic tone for the period ahead, supported by a stronger external and fiscal position, according to a report released by the Finance Ministry on Thursday.

“Pakistan’s economy started FY2026 with positive developments from the sustained improvements in FY2025 and setting a promising tone for the months ahead,” says the monthly update and outlook for August 2025.

Government measures for investment facilitation, along with reforms to support private sector-led growth, easing inflation, and accommodative monetary policy, are likely to reinforce business confidence.

A favourable global environment, stronger demand from trading partners, and the recent trade deal of Pakistan with the US are expected to boost exports, while workers’ remittances will help contain trade deficit pressures from tariff rationalization-driven imports.

However, flood-related damages may add fiscal pressures and disrupt food supplies in affected areas, the report says, adding that inflation is projected to remain within the range of 4-5 per cent in August 2025.

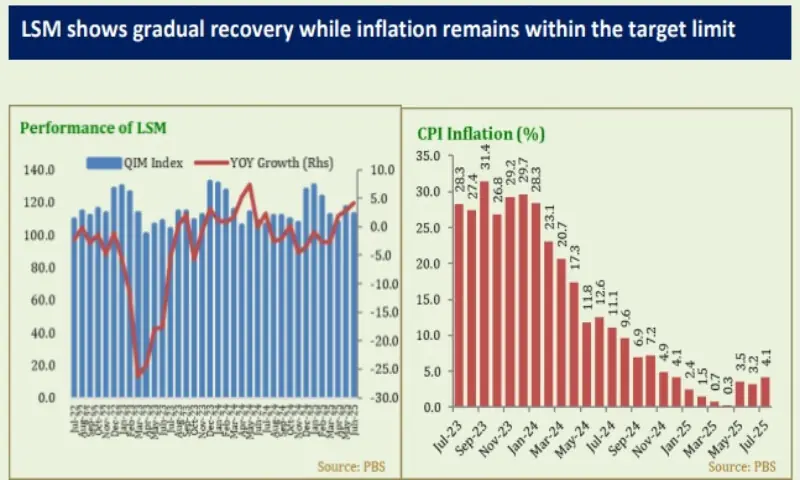

According to the report, the Consumer Price Index (CPI) inflation remained moderate, suggesting that inflationary expectations were well-anchored through a mix of administrative measures and policy reforms along with prudent economic management.

The headline Inflation was recorded at 4.1 per cent Year-on-Year basis (YoY) basis in July 2025, compared to 3.2 per cent in June 2025 and 11.1 per cent in July 2024. On a Month-on-Month (MoM) basis, it increased by 2.9 per cent, following a 0.2 per cent increase in June 2025 and a 2.1 per cent increase in July 2024.

Likewise, in July FY2026, the external sector showed a favourable performance, with a narrower current account deficit and a stable exchange rate, while tax collection by the Federal Board of Revenue (FBR) recorded a significant growth.

These trends highlight a stable macroeconomic foundation at the beginning of FY2026, the report said, adding that the stability achieved in FY2025 and sustained improvement in macroeconomic indicators prompted international credit rating agencies to upgrade Pakistan’s sovereign outlook, reaffirming confidence in the economic direction and reinforcing the credibility of ongoing reform efforts.

The report said that agricultural credit disbursement rose by 16.3% to Rs2,577.3 billion in FY2025, while agricultural machinery imports surged 123.9% to $14.4 million in July FY2026.

The Large-Scale Manufacturing (LSM) sector registered a year-on-year (YoY) increase of 4.1 per cent in June 2025, while month-on-month (MoM), it declined by 3.7 per cent.

Cumulatively, LSM output declined by 0.74 per cent during FY2025, compared to a marginal growth of 0.78 per cent last year.

The FY2025 concluded with notable improvement, supported by strong revenue growth and prudent expenditure control.

The fiscal deficit narrowed to 5.4 per cent of GDP from 6.9 per cent in FY2024, the lowest in eight years.

The primary surplus rose significantly to Rs2,719.4 billion (2.4% of GDP) from Rs952.9 billion (0.9%), the highest in 24 years, driven by contained non-markup expenditures.

Total expenditure grew by 18.0 per cent to Rs24,165.5 billion, with current spending increasing by 15.9 per cent to Rs21,528.6 billion.

This moderation created space for development, as federal PSDP rose sharply by 43.3 per cent.

On the revenue front, tax collection grew by 26.2 per cent, while non-tax revenues surged by 65.7 per cent.

In July FY2026, the FBR’s tax collection increased by 14.8 per cent to Rs757.4 billion, with the 12.5 per cent increase in domestic tax and 31.2 per cent rise in customs duty.

In July FY2026, the current account posted a deficit of $254 million, lower than the $348 million deficit recorded in July FY2025.

Goods exports increased by 16.2 per cent to $2.7 billion, while imports rose by 11.8 per cent to $5.4 billion, resulting in a trade deficit of $2.7 billion compared to $2.5 billion last year.

On July 30, 2025, the Monetary Policy Committee kept the policy rate unchanged at 11%, citing a slight uptick in the inflation outlook due to higher-than-expected energy price adjustments, despite favourable June inflation figures.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.