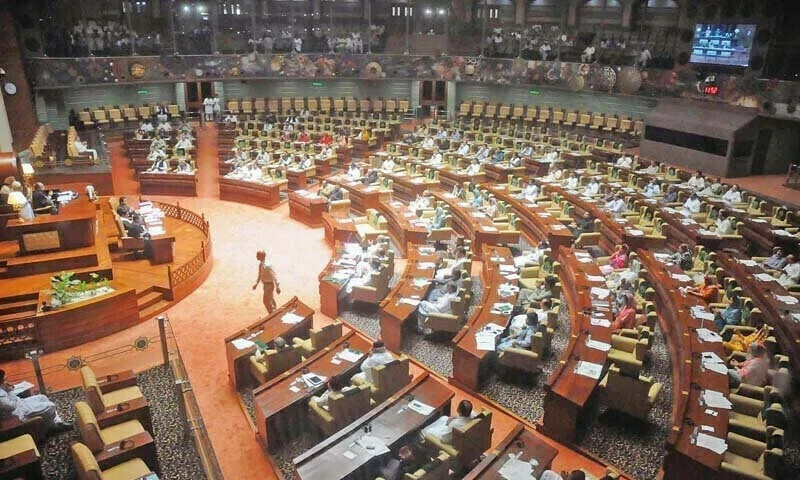

Sindh Assembly approves Rs3.45 trillion budget for FY 2025-26

The Sindh Assembly on Wednesday approved a provincial budget exceeding Rs 3.45 trillion for the fiscal year 2025-26.

Presented by Chief Minister Syed Murad Ali Shah, the budget reflects a 12.9% increase over the current fiscal year’s outlay.

Despite intense scrutiny, over 2,000 cut motions submitted by the opposition were dismissed, with the lone exception being a motion on allowances for judiciary employees.

The newly passed budget includes approval for all development grants. The assembly also approved a Rs156 billion supplementary budget.

Among the major highlights is the withdrawal of six taxes, including the professional tax, which is expected to provide Rs5 billion in relief to the public.

Murad Ali Shah announced new tax measures set to take effect from July 1, 2025. These include a 19.5% tax on services related to vehicle security systems, including trackers, surveillance cameras, alarms, internet, telephone, Wi-Fi, and broadband.

A 3% tax will be levied on vehicle transactions, while online payments to restaurants, hotels, and farmhouses — as well as on beverages — will incur an 8% tax.

However, a range of services and sectors will remain exempt from the sales tax. These include services used by parliament and assembly members, local government representatives, and tribunal judges.

Additional tax exemptions apply to private housing construction on plots up to 10,000 square feet, health and life insurance policies up to Rs500,000, and Hajj and Umrah travel operators.

Shah described the budget as “pro-people, development-oriented, and focused on equitable growth.”

The government aims to ease the tax burden while promoting economic development through incentives for agriculture, transportation, and small businesses.

Notably, Rs8 billion will be disbursed via the Sindh Hari Card initiative, with up to 80% subsidies for large-scale farmers.

Further tax relief includes reductions for online ride-hailing and bus services, removal of dredging and local cess in the agricultural sector, and tax exemptions on agricultural insurance and storage.

Annual tax on commercial vehicles has been capped at Rs 1,000.

In a major move for the cultural sector, entertainment duty has been fully abolished. Theaters, cinemas, water parks, and cultural events will no longer be taxed.

The assembly approved all 188 demands for grants presented during the session.

Shah concluded his budget speech by calling it a “people-friendly, progressive, and inclusive” budget aimed at economic recovery through tax relief and strategic development investments.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.