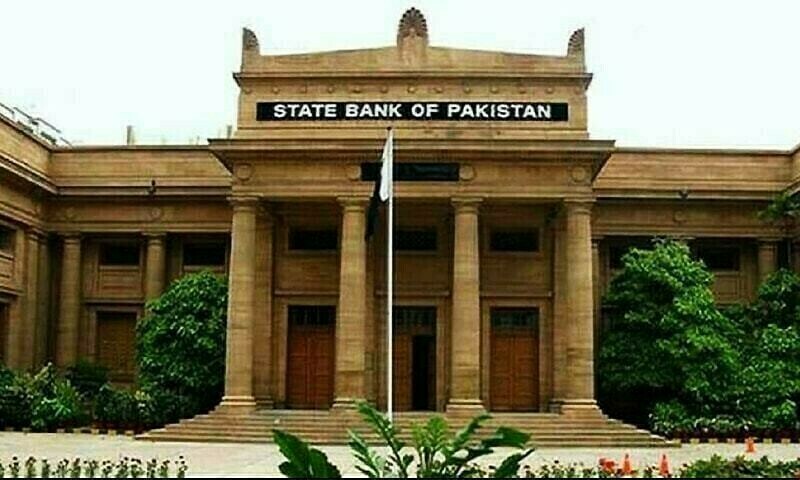

SBP keeps policy rate unchanged at 11% to maintain economic stability

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) decided on Monday to maintain the policy rate at 11%, citing inflationary risks, external sector vulnerabilities, and the need to sustain macroeconomic stability.

In its policy statement, the MPC noted that May’s year-on-year inflation rose to 3.5%, in line with expectations, while core inflation saw a marginal decline.

Inflation is projected to gradually increase but remain within the 5–7% target range during FY26.

The committee highlighted a gradual pickup in economic growth, forecasting stronger momentum in the coming year due to the lagged effects of previous rate cuts.

However, it also flagged growing concerns over the trade deficit and weak financial inflows, warning that proposed FY26 budget measures could further pressure the external account by boosting imports.

“This decision is appropriate to preserve macroeconomic and price stability,” the MPC stated.

Key developments

-

Provisional real GDP growth for FY25 is estimated at 2.7%, with the government targeting 4.2% in FY26.

-

Despite a widened trade deficit, the current account remained broadly balanced in April.

-

Completion of the first IMF EFF review resulted in a $1 billion disbursement, lifting SBP’s reserves to $11.7 billion as of June 6.

-

The revised primary balance for FY25 stands at a 2.2% surplus of GDP, with a 2.4% target set for FY26.

-

A sharp rebound in global oil prices, due to Middle East tensions and easing US-China trade relations, was also noted.

The committee observed that the real interest rate remains sufficiently positive to help anchor inflation within the desired range.

It stressed the importance of securing planned foreign inflows, achieving fiscal consolidation, and implementing structural reforms for long-term stability.

Inflation outlook and risks

The MPC anticipates limited inflationary impact from the recent federal budget but expects short-term volatility. Risks include regional conflicts, fluctuations in global commodity prices, and domestic energy price adjustments.

Market Expectations

Market analysts largely predicted a status quo, citing improved domestic indicators but persistent global uncertainties.

Arif Habib Limited remarked that the SBP is likely taking a cautious approach given geopolitical developments, particularly the surge in oil prices.

“Global crude benchmarks have spiked by 10–12% week-on-week, posing fresh inflationary risks for oil-importing countries like Pakistan,” AHL stated.

Topline Securities echoed this sentiment, noting that anticipated energy price notifications and heightened geopolitical tensions warrant policy caution.

A Reuters poll also indicated expectations for the rate to remain unchanged, as inflationary pressures from rising commodity prices remain a concern.

“Upside risks to global commodity prices could reintroduce inflationary pressures,” said Ahmad Mobeen, senior economist at S&P Global Market Intelligence.

For the latest news, follow us on Twitter @Aaj_Urdu. We are also on Facebook, Instagram and YouTube.

Comments are closed on this story.